The cost of going out drinking has increased ahead of Christmas, with wine, gin and whisky prices rising.

All alcohol prices rose last month at pubs, restaurants and cafes, with the cost of bitter and lager also up.

The amount you pay for a night out is now increasing at its fastest rate since 1991, official figures show.

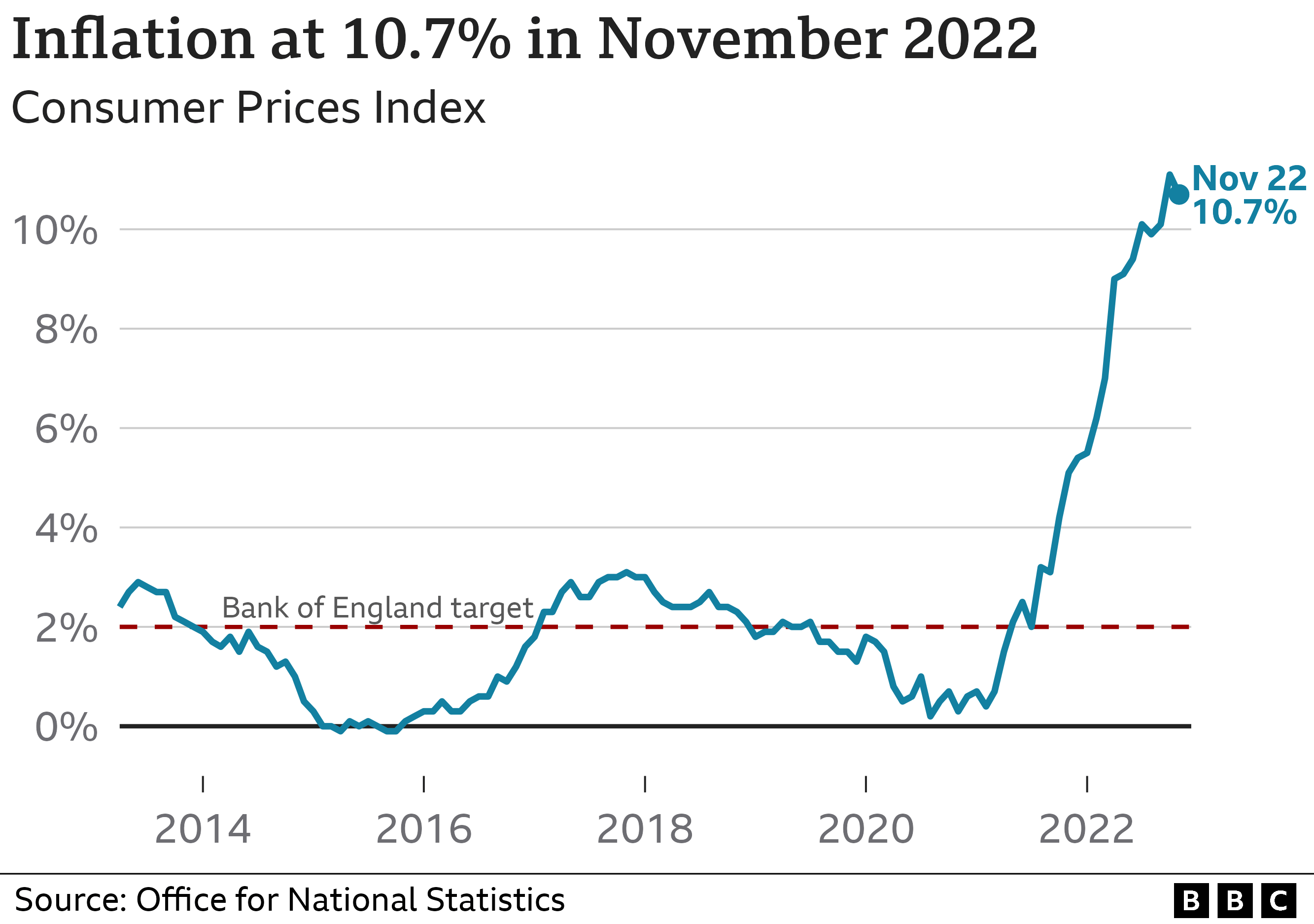

It came as overall inflation – the rate at which prices rise – eased slightly but the cost of living is still rising at its fastest pace in 40 years.

Prices increased by 10.7% in the year to November, compared with 11.1% in October, leading some analysts to predict that soaring inflation may now slowly begin to fall.

Inflation is a measure of the cost of living and to calculate it, the Office for National Statistics (ONS) keeps track of the prices of hundreds of everyday items.

Lower inflation does not mean the prices of goods will go down, just that they will stop rising as quickly.

The fall in the overall rate of inflation in November was due to petrol prices easing from record highs, and lower prices for second hand cars.

However, the price of drinking alcohol in pubs, restaurants and cafes rose between October and November, compared with falls a year ago, when some businesses offered discounts.

The biggest price rise was for whisky, up 7.8% in the month, while gin, draught premium lager, draught bitter and wine by the glass were up by between 1.2% and 1.7%.

The price of eating out and getting takeaways also increased slightly, while grocery bills continued to rise.

While the prices of drinks tend to be volatile, pubs and restaurants have been forced to put up prices as they struggle with soaring energy bills, higher wholesale costs and rising wages.

The boss of one pub chain has warned pubs face a “bleak” future as costs climb and customers rein in their spending.

Kate Nicholls, the head of industry group UK Hospitality boss, said: “While the headline rate of inflation has reduced slightly, it remains the case that hospitality businesses are seeing intense inflation in every aspect of their operations.”

This inflation “will not disappear overnight”, she added, and prices could rise further in March if the government ends its energy bill support for hospitality businesses.

Emma McClarkin, chief executive of the British Beer and Pub Association said the last thing pubs wanted to do was put prices up, but added “without let up in rising overheads, it’s difficult to see how many will carry on”.

“Many [pubs] just managed to pull through the pandemic, but what we are facing now is crippling businesses at an unprecedented rate,” she said.

Billy Williams, who runs Reading Winter Wonderland, said he had noticed a rise in phone calls asking for group discounts on rides at the annual Christmas event.

“A lot of people are paying with credit cards now rather than debit cards,” he added.

He said entry to the event was still free and ticket prices for attractions had not gone up for three years, but that could change as his overheads rise.

“There is going to come a time if prices keep increasing that we will have to pass that on to customers,” he told the BBC.

The dip in the overall rate of inflation in the year to November should be the start of a few months of falls. October’s four-decade high now looks to have been the peak. But inflation will remain very high for months to come.

Even in the latest figures, food price rises reached new 45-year highs of 16.5%, as is evident in the shops. But its not just petrol prices contributing to a slowing of the inflation rate. Other commodity prices and transport costs are on their way down. The fall in the price of used cars – one of the first indicators of the inflationary pressures last summer – is now accelerating.

While households still face an historic squeeze from the cost of living, the Bank of England may feel able to slow up on rises in interest rates, especially given expectations a recession has already started.

In the absence of further shocks to the world economy, it may be that the very worst is now behind us.

Consumer prices have been rising this year as energy, fuel and food costs soar due to the war in Ukraine and Covid.

But while the inflation rate eased in November, households are still facing a “tough winter ahead”, warned Joanna Elson, chief executive of debt charity the Money Advice Trust.

She said government support for energy bills would provide some relief, but that the challenge of affording essentials such as food and heating “isn’t going away… and for many is only set to get harder with the cold weather”.

Chancellor Jeremy Hunt said tackling inflation remained his “top priority”, and suggested November’s fall did not mean it could raise public sector pay. Anger over how it has lagged behind soaring prices has led to widespread strikes.

“I know it is tough for many right now, but it is vital that we take the tough decisions needed to tackle inflation – the number one enemy that makes everyone poorer. If we make the wrong choices now, high prices will persist and prolong the pain for millions.”

But shadow chancellor Rachel Reeves said: “The question people across Britain will be asking themselves this morning is: ‘Do I and my family feel better off under the Tories?’ The answer will be no.”

Leading economists including Paul Dales of Capital Economics and Samuel Tombs of Pantheon Macroeconomics said that November’s figure showed inflation had UK peaked and price rises would continue to slow down.

But Grant Fitzner, chief economist at the ONS, told the BBC’s Today programme that it was “too early” to tell.

“We’ve only one fall from a 40-year high so let’s wait a few months and see how it goes,” he said.

November’s fall also didn’t change expectations that UK interest rates will raise interest rates again on Thursday.

The Bank of England has been increasing rates to try to curb inflation. Putting up interest rates can mean people are more likely to save money, and less likely to borrow money.

In theory this means they have less money to spend so will buy fewer things, which should help stop prices rising as quickly.

Interest rates are expected to increase from 3% to 3.5%. – bbc.com