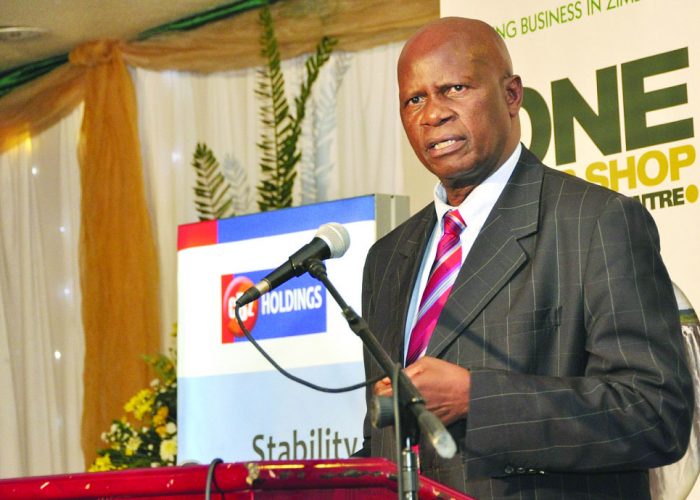

FINANCE Minister Patrick Chinamasa will today present the much-awaited 2014 National Budget, expected to determine the course of Zimbabwe’s feeble economy currently beleaguered by a liquidity crunch.

FINANCE Minister Patrick Chinamasa will today present the much-awaited 2014 National Budget, expected to determine the course of Zimbabwe’s feeble economy currently beleaguered by a liquidity crunch.

Treasury sources said while Chinamasa would have to deal with a plethora of issues raised by his ZANU-PF party, his major battle would be to rein in a widening current account deficit, triggered largely by the high import bill which has worsened the liquidity crunch in the economy and threatens the stability of the financial sector as well as the viability of local industries due to demand challenges created by lack of disposable incomes.

The budget will be the first under a single party government since Zimbabwe ditched its defenceless currency in 2009 and adopted a multi-currency regime anchored around the United States dollar.

A coalition government formed in February 2009 between President Robert Mugabe and two MDC formations led by Morgan Tsvangirai and Welshman Ncube ended with ZANU-PF’s landslide victory in polls held on July 31.

Apparently, Chinamasa will be guided by the ZANU-PF economic blueprint, the Zimbabwe Agenda for Sustainable Socio-Economic Transformation (Zim Asset), which the party reaffirmed as the guiding principle for economic revival at its annual conference held in Chinhoyi last week.

Witness Chinyama, a Harare-based economist, said Chinamasa would have to work “within the realities of our economy”.

“Some of the issues in Zim Asset will require a lot of money and are long-term. The reality on the ground is that there is very little cash to fund the budget,” said Chinyama.

David Mupamhadzi, another economist, concurred: “The biggest challenge for this budget is lack of fiscal space. This budget should, from a policy perspective, be used to anchor Zim Asset — to ensure that the aspirations of Zim Asset are fulfilled through the budget. But this will fall short because of lack of funding.”

Indeed the challenge for Chinamasa will be enormous: The budget will have to confirm the promised salary increase for civil servants through increased allocation for the salary and wage bill, while also increasing fiscal support to the productive sectors, notably agriculture and manufacturing, both of which are haemorrhaging and desperate for recapitalisation. President Mugabe has already spelt out that the planned salary hikes should take the lowest government incomes above the poverty datum line, currently at over US$500.

At the just-ended ZANU-PF conference held in Chinhoyi, President Mugabe implored Chinamasa to “find money” for the salary increases, saying: “You can’t say there is no money…..We can’t really be at peace with ourselves if we say our people must continue to work for next to nothing.”

The proposed salary increases will inevitably more than treble the salary and wage bill for government, a situation that will certainly create fiscal problems for Chinamasa.

In 2011 and 2012, public sector salary increases, which were marginal, crowded out spending in key areas. This resulted in fiscal stress, including the accumulation of domestic payments arrears, which necessitated significant adjustment to the 2012 budget in the second half.

Government is currently battling underfunding, and Chinamasa last month appealed to the International Monetary Fund to “have some flexibility” to fund the Zimbabwe government, currently in arrears with the Bretton Woods institution and other multi-lateral and bilateral financiers.

Alluvial diamonds from Marange, which many believed would fund Treasury, have dried up. They are being mined by the government-owned Zimbabwe Mining Development Corporation, in partnership with foreign and local shareholders.

In its Zim Asset document, ZANU-PF said it acknowledged “the continued existence of the illegal economic sanctions, subversive activities and internal interferences from hostile countries”.

The party therefore called for “sanctions busting strategies,” imploring its members in government to focus on the “full exploitation and value addition to the country’s own abundant resources”.

There are fears this could imply a clampdown on players in the sector, a move that could further undermine foreign investor confidence in the sector.

In fact, President Mugabe gave the platinum miners a two-year ultimatum to open a refinery in the country so that they would not move matte to South Africa.

Chinamasa might be forced to balance political rhetoric with the need to create a conducive environment for business and foreign direct investment. But still, it appears his party is looking for near-term solutions to the economic problems to break out of the joke that if they could rig elections, as they are alleged by their opponents to have done, they cannot rig the economy.

The immediate challenge for the budget would therefore be to create food security and ensure that millions of people said to be under threat of hunger do not starve to death.

Agricultural production, which was severely affected by agrarian reforms, will need to be restored. In the inclusive government, ZANU-PF had accused former finance minister Tendai Biti of under-funding the sector to undermine ZANU-PF’s agrarian reforms. Now, they have that portfolio all to themselves. The budget would also have to ensure that adequate cash is made available to rejuvenate social services, particularly health and education, and eradicate poverty.

There is also need to revamp the country’s collapsing infrastructure and utilities, particularly electricity generation which has also been a major constraint to productivity in the country.

It is not as if President Mugabe and his party are not aware of the cash crunch militating against Chinamasa in trying to come up with a budget that can transform Zimbabwe’s fortunes and turn the country into an economic miracle.

The Zim Asset document clearly indicates that fiscal space remains severely constrained due to poor performance of revenue inflows against the background of rising recurrent expenditures and a shrinking tax base.

“The economy has also been saddled with a high debt overhang with an estimated debt stock of US$10 billion as at December 2012 caused by the country’s failure to access international capital and investment inflows as illegal economic sanctions have not been removed,” said the document.

The blueprint also acknowledges the fact that agriculture is suffering due to “lack of agricultural financing and lack of affordable inputs”.

The manufacturing sector is equally in the doldrums.

Mupamhadzi said the major headache for Chinamasa was that currently, revenue inflows are coming down, as are export receipts.

Chinyama said the burden for the budget will remain largely on the domestic taxpayer, who is equally cash-strapped.

Balance of payments support from offshore funders ceased over a decade ago when Zimbabwe defaulted on its loan repayments, and credit lines from even neighbouring countries like South Africa and Botswana, which was promised soon after formation of the inclusive government and led to hurried signing of bilateral trade agreements, have not materialised.

“We still have the same challenges,” said Chinyama. “I don’t think there will be enough funding to give to ministries so that they can also adequately support economic sectors like agriculture.”

He said Chinamasa will have to simply provide a conducive environment for investment and “everything will become easier”.

Mupamhadzi said: “The question is: How do you balance the aspirations of the five-year plan (Zim Asset) with the immediate needs of the country?” It’s a question Chinamasa might have to give an answer today. newsdesk@fingaz.co.zw