TRUWORTHS Zimbabwe will be trenching next year to reduce trading and employment costs. The company says it was not expecting a buoyant Christmas. Most Zimbabweans are faced with dwindling disposable incomes due to a persistent liquidity crisis and company closures in an unstable economic environment.

TRUWORTHS Zimbabwe will be trenching next year to reduce trading and employment costs. The company says it was not expecting a buoyant Christmas. Most Zimbabweans are faced with dwindling disposable incomes due to a persistent liquidity crisis and company closures in an unstable economic environment.

Speaking at the company’s Annual General Meeting group chief executive Themba Ndebele said trading expenses for the four months to October were down nine percent compared to the same period last year. He said employment costs were also down 4,8 percent due to cost cutting measures while head count at store level and head office down 3,8.

“Apart from reducing head count at store level. We expect further reduction in head count at head office going forward,” said Ndebele. He however could not say how many people the company intends to retrench next year. Ndebele said “good customers” were now shrinking and purchases were being made once every four/five months. Feet count into the stores is averaging 70 000-73 000 per month but of that 25 percent results into sales. It is pleasing we still have the traffic coming through in light of the current retail environment but we need to improve further on the statistic,” he said.

The company’ merchandise sales during the period under review were down 26,9 percent compared to the same period last year. Ndebele said the sales were “massively distorted” due to the introduction of credit cards last year in October. “We expect merchandise sales numbers to normalise by end of November into December…We expect buoyant Christmas trading but not to the same levels as last year due to poor disposable incomes and a significant segment of our market getting paid on 24 December 2013,” he said.

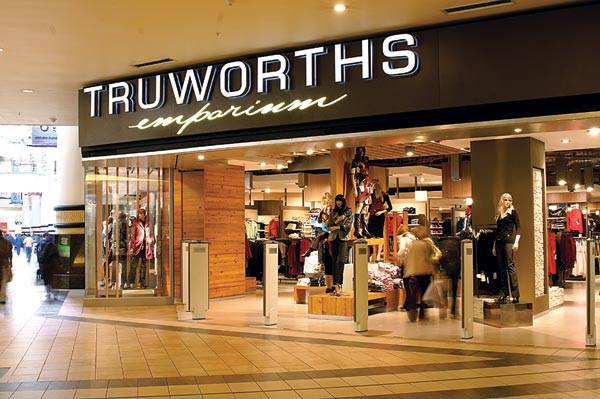

Traditionally Truworths expects a dramatic turn in fortunes during the festive season. The introduction credit cards is also expected to increase sales in future. Truworths entered dollarisation on a cash basis in February 2009, with a turnover of US$1,38 million, which had gradually improved with the introduction of credit terms.

A deteriorating credit and consumer environment has since last year seen Truworths report a decline in several aspects of the business. Retail merchandise sales for the year to June 2014 were down to US$23,8 million from US$25,3 million prior year. The biggest decline in sales was in Topics down nine percent, followed by Truworths Stores down 7,7 percent and Number 1 down 2,9 percent during the period under review.

Earnings per share was at 0,09 cents against 0,32 cents last year. Margins also came off with gross margins coming down to 50,6 percent from 52,2 percent. Operating margins were lower at 2,2 percent against 6,7 last year. While sales were coming off, expenses were going up with the ratio of trading expenses to turnover increasing to 50,6 percent up from 46,6 percent. The Group generated less cash in the period with cash generated from operations coming down to US$84 070 from US$1,5 million last year.

Ndebele said the group’s debtors’ book for the period under review has performed in line with management expectations.

Truworths would manage its debtors’ book by controlling the number of account holders and monitoring those who have a record of defaulting in light of the increased liquidity challenges prevailing in the country to improve net profit.