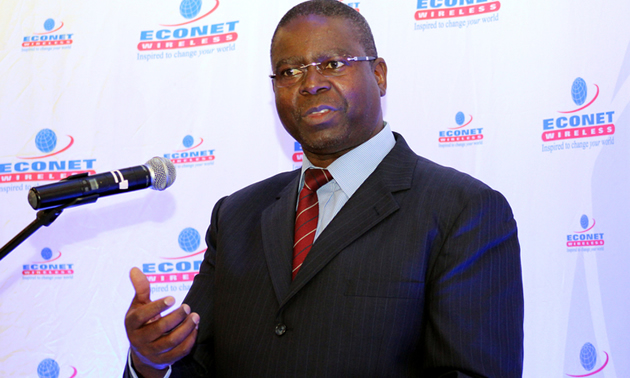

Econet CEO Douglas Mboweni

Econet Wireless through its Ecocash mobile finances services, has launched a new partnership for Europe remittances, known as Chitoro.

Chitoro offers money transfer methods that allow for both business to business (B2B) transfers and worldwide person to person (P2P) payments. The fees for remittances or transfers will range from 1,99 British Pounds. Recipients can tchoose to use the funds at any EcoCash point of sale service facility or to cash out the money at any EcoCash agent. They can also be paid out in cash at any Steward Bank or CABS branch

Chitoro, a subsidiary of Econet Wireless Group through Cassava Connent, is authorized by the Financial Conduct Authority in the UK to provide financial services across the UK and Europe as a prudent and world class remittance business.

Speaking at the launch of the partnership, Central Bank Deputy Governor Kupukile Mlambo said Diaspora remittances were a great source of Zimbabwe’s liquidity.

“The Bank and policymakers are working hard to have policies and systems that encourage electronic money transfer, electronic banking and the use of plastic money.

Econet COO Fayaz King said Ecocash had come onto the market to change the lives of Zimbabweans for the better and since September 2011, the brand had innovated to bring in partnerships with other brands like Mastercard, Moneygram and Western Union.

“Today we witness another partnership, another growth, another driver to bring remittances into the country, to bring money to those who need it the most,” said King.

King added that Ecocash had provided the conduit in which remittances can find their way into the country.

Ecocash General Manager Natalie Jabangwe said Econet did not want to remain only in providing telecommunications services and mobile financial services for the people of Zimbabwe but was determined to go to those uncharted places where no other telecommunication company in Zimbabwe has been.

“Econet is pleased to announce the partnership with Chitoro for international remittances. It gives us the ability to send money from the whole of the United Kingdom and many other countries that will follow,” she said.

She added that the Chitoro service would available 24 hours a day, 365 a year, at a low cost and more convenient than the traditional remittance options available.

“It is secure, provides the best practice in terms of security and fraud management procedures and the steps to use it are easy, quick and convenient.”

The money would be transferred to the recipient within seconds and the charges would depend on the amount of money to be sent, with no additional charges on the recipient to receive the money into their Ecocash wallet.

The normal Ecocash charges would however apply on Ecocash transactions like cash out, paying merchants and the ability to pay bills.

Chitoro’s Director, Haxton Rose said the partnership with Ecocash has allowed Chitoro to operate on a much larger scale, giving them access to over 25 000 Ecocash agents and the ability to pay to over 5 million Ecocash wallets.

“For our customers, this is great news as it offers them more choice and convenience in sending money to Zimbabwe for their loved ones,” said Rose.

“We understand the importance of providing value for our services that is why we will continue to ensure that with Chitoro our fees will always be competitive.”

Follow us on Twitter on @FingazLive and on Facebook – The Financial Gazette