THE Reserve Bank of Zimbabwe on December 5 unveiled a set of new bonded coins worth $10 million, which will start circulating on December 18, in a bid to ease the shortage of lower denomination currency, but repeated assurances it would not bring back the local currency.

Zimbabwe follows the recent examples of Ecuador and East Timor, dollarized economies which introduced locally minted coins known as centavos – derived from the Latin word for a hundredth — with a par value with US currency in 2000 and 2003, respectively.

Zimbabwe adopted the use of multiple foreign currencies – mainly the US dollar and neighbouring South Africa’s rand — in 2009 to curb runway inflation which peaked at 500 billion percent in 2008 and destroyed its local currency. But the country’s consumers have struggled with change, a factor blamed for higher prices compared to regional countries as traders round up prices.

According to the central bank, about 80 percent of trading in the country is conducted in US dollars, with the rest being in rand and Botswana’s pula.

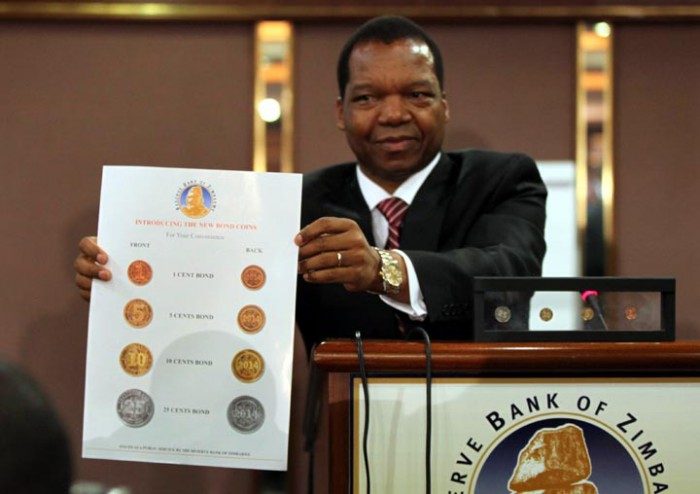

RBZ governor, John Mangudya told journalists during a press briefing that the special coins of 1c, 5c, 10c, 20c, and 50c, whose values would be at par with the US cents, were part of a five-year $50 million bond that government had secured to give them value.

He ruled out the return of the Zimbabwe Dollar saying that it would be “careless” and economic “suicide” as there was no production and reserves to anchor it on and the country has foreign currency reserves of up to three months.

“There are no fundamentals to bring back the local currency. We have no appetite to do so, and we can’t be careless to do so and we won’t do that,” he said, while responding to a question on whether this was a way of returning the local currency.

Mangudya said despite “plenty of goodwill” in terms of investment into the country, it would require about five years to start considering the return of the local currency.

The new coins, which were minted in South Africa, are denominated in one cent, five cents, 10 cents and 25 cents will start circulating on December 18 while the 50 cents coin will start circulating next March as it took long to mint due to its enhanced security features, he said.

“The Reserve Bank is therefore addressing the divisibility …. through this initiative which has already received significant support from the Consumer Council of Zimbabwe, business organisations and financial institutions,” Mangudya said.

The initial $10 million coins are equivalent to two percent of total current bank deposits and would be maintained at below 10 percent, according to Mangudya. Under normal circumstances, coins in issue should be equivalent to between 20 and 25 percent of total bank deposits.

At least 30 million rand coins would also be imported to augment the bond coins.

Mangudya said for transparency and accountability, the whole process would be subject to public scrutiny and would be audited by the Institute of Chartered Accountants of Zimbabwe.

Mangudya said he expected the introduction of the coins to result in the reduction of the prices on the market, which had been constrained by the absence of an appropriate system of coins.

“These coins shall therefore go a long way in mitigating the country’s lopsided pricing structure for the convenience of consumers,” he said.

Meanwhile, the central bank chief said the other currencies such as the Chinese Yuan, Rupee, Yen which were introduced earlier this year were not popular on the market.

“We were looking at where Zimbabwe was exporting and importing its goods. We thought naturally that the consumers and business would prefer to deal in those currencies but alas, the demand in those currencies has been low,” he said. Chipo Musoko/The Source