IT is not one for the faint-hearted, and even the steely may break at the task Zimbabwe’s Treasury chief, Patrick Chinamasa, is facing. To say it is daunting maybe an understatement; the challenge to turn around an ailing economy, against the background of a liquidity crunch, company closures, increasing unemployment and informalisation of the economy, is more than dreadful.

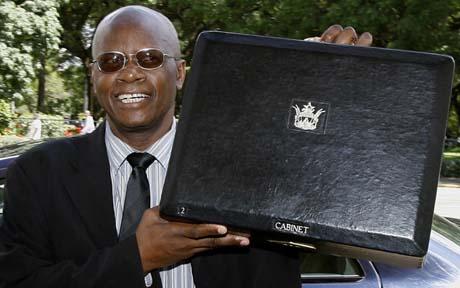

Add to that the bickering in the ruling ZANU-PF party, which has preoccupied decision-making within government and the ruling party itself, then you understand economic revival has been shelved and that Chinamasa, who is already in a fix, has no one for a piggyback ride. Today, he is expected to present the 2015 national budget everyone hopes will turn their misery into happiness — but that is just a matter of hope and everyone knows this will only take some Houdini magic. OK, for the religious, it needs God. But, as one banker says, Zimbabwe is likely to continue on a downward trajectory.

So brace for more pain. “The government will need to raise more funding against a shrinking tax base, so that means more taxes for the few (already in the tax net),” said the banker who declined to be named. “Expect more taxes, ” he warned. Zimbabweans can say we have been on this journey before, because this certainly sounds very familiar.

In his delayed mid-term fiscal policy review in September, Chinamasa increased tax on fuel — both diesel and petrol. Excise duty on diesel and petrol had been pegged at 25 and 30 cents per litre respectively. It went up, effective September 15, 2014, to 30 and 35 cents per litre for diesel and petrol respectively as Chinamasa sought to “raise additional revenue to finance inescapable expenditures”.

He also reviewed upwards fees and charges for rental of government accommodation. These, he said, played “an important role in augmenting tax revenues necessary to enhance service delivery”. “It is, thus, important to continuously review these fees and charges taking account of developments in the economy, in particular increased costs for provision of services,” said Chinamasa. Truthfully, the fundamentals of the current economy would call for a downward review of such fees and charges; Zimbabweans have experienced an unprecedented erosion of disposable incomes, and would do with any form of relief.

But even if government were to cite increased costs for provision of services as the reason for the hike in the fees and charges, there is an antithesis to this decision — the increasing costs for the provision of services are pushing more and more people into abject poverty and they equally need respite. But that is not the way Chinamasa will want to see things.

Simply because rentals for housing units under the National Housing and National Guarantee Funds were last reviewed in 2010, he argued that there was need for an upward review. This is the kind of thinking that will influence his proposals today.

The rentals for housing units ranged from US$20 to US$500 per month, and Chinamasa pushed them up by various margins. He introduced a five percent excise duty on air time for voice and data, ensuring a massive tax net that would affect the rich and the poor, the happy and the sad. He also levied customs duty on mobile handsets at a rate of 25 percent.

Previously, government had, in August 2009, reduced customs duty on mobile handsets in recognition of access to information as an essential tool to enhance decision making in the global village, and also to encourage the development of Information Communication Technology (ICT), in line with international trends. In his view, that has already been achieved: Mobile phone handset purchases have increased significantly, and mobile telephone penetration rates have also increased substantially to over 100 percent. True, this is a milestone.

“Customs duty reduction has, thus, achieved its intended purpose,” Chinamasa said.

But that was not the motive for the new customs duty on phone handsets, as well as on fuel and airtime; Chinamasa did not seek to conceal the fact that government was desperate for money, and would seek it from whoever showed signs of comfort.

“Government faces a challenge to raise additional revenue to finance non-discretionary expenditures,” Chinamasa said when he explained his motive for the new and higher tax thresholds.

The challenge — there are many of them in fact — still subsists. In fact it is getting worse. By September, government had run a budget deficit of US$28,46 million. This indicates an acceleration of fiscal pressure. So, who still has cash among us? You have reason to fear. Industry players say a number of their executives have been put under the spotlight, with the Zimbabwe Revenue Authority (ZIMRA) undertaking what they describe as lifestyle audits. This will dominate the coming financial year.

The audits are targeting even those with eye-catching mansions in Harare’s leafy suburbs. So, for those that built these stately homes to get the attention of the miserable lot wallowing from a struggling economy, there is someone from whom to get that attention now, except it is not going to be pleasant. Under a window Chinamasa granted for businesses to own up to tax arrears, the Treasury chief hopes to mop up more revenue from tax evaders.

The amnesty will cover all taxpayers in respect of their tax obligations for the period beginning February 1, 2009 to September 30, 2014, without any further extension. No penalties and interest will accrue on the tax obligations within the period of the amnesty, which started on October 1. While admitting that the country has experienced economic challenges over the past decade, he does not want to believe these have affected the business community so much that they have failed to pay taxes.

Chinamasa avers that the economic challenges “have resulted in a number of companies neglecting their tax obligations in order to fund their operations”. They now have to admit to their delinquency and agree on terms in the repayment of “neglected” tax obligations, minus potential penalties to save them from hefty claims.

ZIMRA commissioner-general, Gershem Pasi, has already warned that if the tax collector was ruthless before this amnesty, it is going to become “even more ruthless” after the amnesty. What will this do to an ailing economy? It is easy to say we know, but Chinamasa will remind us today that it is important for citizens to pay taxes. True, government needs money to perform civil duties and govern the country. This money is collected, largely, from the citizens in the form of tax. Without tax, government business can easily collapse, and this would obviously create chaos.

But to hear industrialists say it, this is not their intention; most are failing to pay taxes because government has been failing to pay for their services and products. Yet the tax collector, they argue, still insists on his pound of flesh. Chinamasa will present his budget at a time when corporate bankruptcies are on the rise. Some economists recently said new taxation laws need to be seriously considered for valuable mineral classes such as diamonds and platinum. Without such measures, incremental revenue from the normal taxation activities would be futile.

Economic consultant, John Robertson, said Chinamasa should allocate more money to sectors that have strong primary multiplier effects on employment creation. “We need to start creating the platform for reviving the defunct middle class. And the government, being the single largest player in the market now, should have the right priorities in place to create a sustainable middle class to cultivate strong and rising domestic demand that will provide the vital anchor for growth,” Robertson said. Hoping he has an audience! – Paul Nyakazeya/Dumisani Ndlela

newsdesk@fingaz.co.zw