THE Chamber of Mines of Zimbabwe has appealed for a commodity price-linked royalty framework for platinum miners to restore viability and maximise the contribution of the platinum industry to the economy.

Authorities increased royalty for platinum by 180 percent to seven percent from 2,5 percent stating that Zimbabwe needed more value from minerals.

But miners say the increase is impacting negatively on the viability of platinum projects. Platinum producers highlighted that the increase in platinum royalty resulted in a five percent average increase in overall production cost.

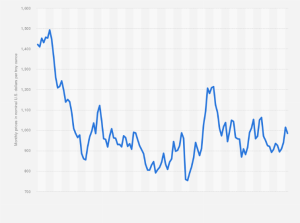

Miners say the situation has been worsened by a slowdown in platinum group metals (PGMs) prices, with most elements of the PGMs basket recording a significant decline in prices in 2023.

Monthly prices for platinum worldwide from January 2014 to June 2024

In its proposal for the mid-term budget statement, the Chamber of Mines recommended a royalty rate of three percent for platinum prices below US$1,100 per ounce and a royalty of five percent for platinum prices above US$1,100 per ounce.

“This royalty framework is in line with best practice and has been successfully applied for the gold sector, thus, we feel that the same framework can assist platinum producers during the depressed price environment and can also maximise revenue to government during price booms as is the case for gold at the present moment,” the Chamber of Mines said.

The miners representative body said the platinum producers are operating at full capacity and unlike other mineral subsectors, they have little scope to ramp up production to cover for revenue losses due to softening PGMs prices.

Resultantly, the miners said the contribution of the platinum group metal miners to the economy has been declining over the last year.

The miners also appealed for a review of the Special Capital Gains Tax, highlighting that the rate of tax at 20 percent is ‘too high’ compared to what is obtained in other mining jurisdictions.

The 2024 Finance Act introduced the Special Capital Gains Tax on the transfer of mining titles.

“Of major concern to investors is the application of the tax in retrospect, backdated 10 years and for it to apply even if the titles had been forfeited or abandoned.

“We are of the view that investors or mineral producers that had complied with the law at the time they transferred title should not be affected by this new law as it brings uncertainty on Zimbabwe as a destination for investments,” the Chamber said.

It said the principle of levying the tax on gross proceeds as well on the buyer is against best practice where capital gains tax is chargeable on the transaction gain and is levied on the seller who would have realised a profit on disposal.

Miners recommended that the tax must not be applied in retrospect and that the rate be maintained at five percent as effected in 2017.

On diamonds, the Chamber of Mines appealed for a royalty of around seven percent in line with best practice as well as restoring the viability of diamond producers.

It said royalty for diamonds at 10 percent is impacting negatively on the viability of diamond projects, highlighting that producers of alluvial diamonds which are predominantly low quality are the most affected as their prices have taken a huge knock.

On lithium, the Chamber proposed a royalty of three percent for lithium that supports the full implementation of projects in the expanding lithium sector.

Royalty for lithium went up by 150 percent, from two percent to five percent.

Miners said it is high and unaffordable for lithium producers citing that most projects are still new and would require government support to ensure that they are fully implemented and lithium prices have also tumbled over the past 12 months impacting negatively on the viability of lithium projects.

The Chamber appealed for deferment of the beneficiation tax and recommended a beneficiation roadmap that is aligned to global developments for the PGMs industry, and roadmaps agreed upon with PGMS producers that are finalising construction of their processing facilities.

On foreign exchange retentions, miners recommended for a greater portion of taxes, including royalties, to be payable in ZiG in line with the government’s thrust of creating demand for the local currency.

Miners said the measure will help create a home for the 25 percent mandatory surrender portion liquidated into ZiG and free up some foreign exchange to meet operational requirements and fund expansion projects and construction of beneficiation facilities.

The Chamber of Mines appealed for an affordable and competitive electricity tariff that guarantees the viability of mining companies and recommended an electricity tariff of USc10 per KWh.

newsdesk@fingaz.co.zw