Rises in the cost of clothing and food helped to push UK inflation higher-than-expected last month.

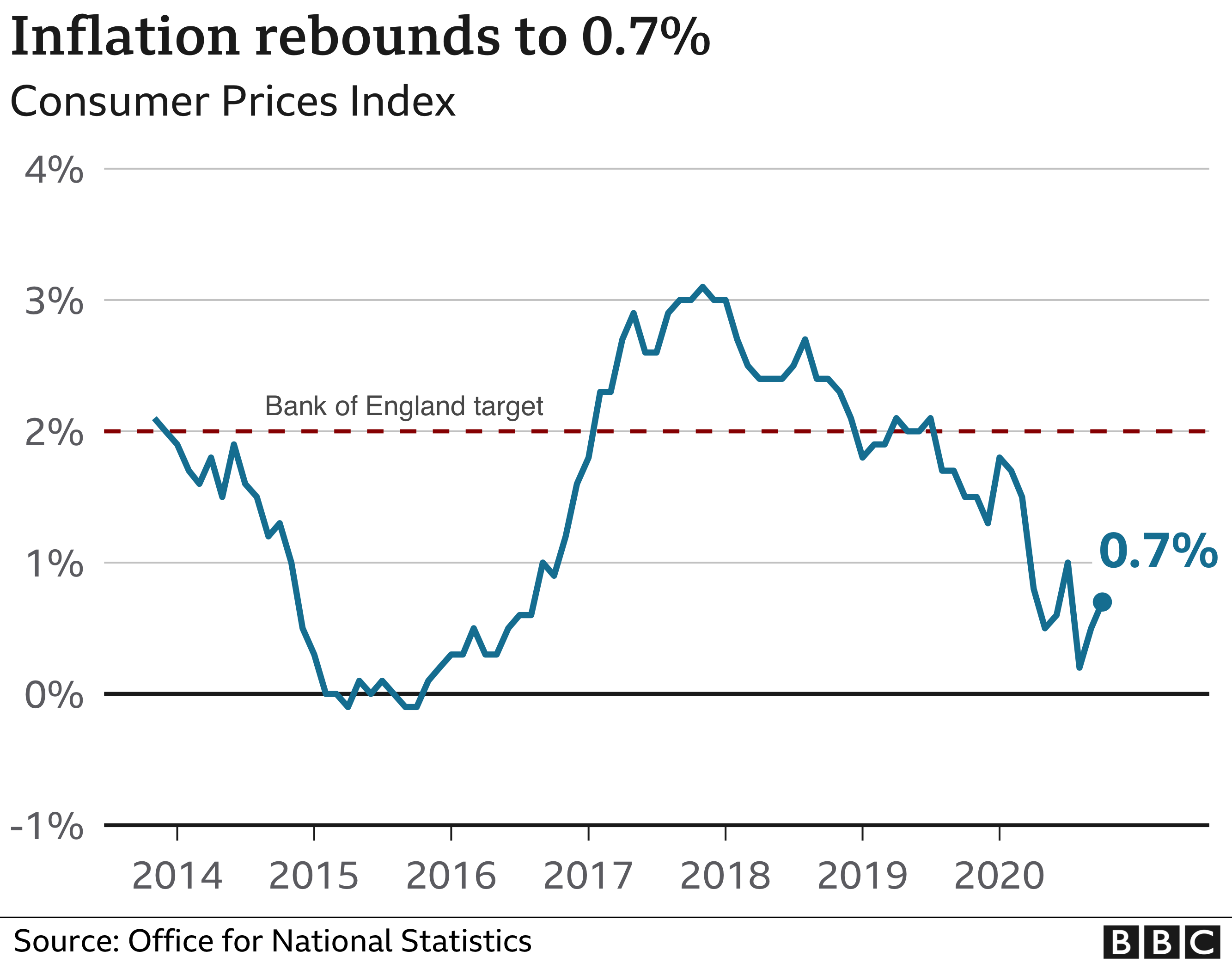

The UK’s inflation rate, which tracks the prices of goods and services, jumped to 0.7% in October from 0.5% in September, official figures show.

Second-hand cars and computer games also saw price rises, but these were partially offset by falls in the cost of energy and holidays.

Analysts had expected the rate to remain flat at 0.5%.

“The rate of inflation increased slightly as clothing prices grew, returning to their normal seasonal pattern after the disruption this year,” said Office for National Statistics deputy statistician Jonathan Athow.

Normally prices for clothes and shoes fall each year between June and July in summer sales before autumn ranges come in, and then rise before sales towards the end of the year, the ONS said.

However, the coronavirus crisis has changed how prices move.

Throughout 2020 this pattern has been different, with increased discounting in March and April, probably as a response to lockdown, it said. After a small increase in July and August, prices rose by more than a year ago.

Inflation is the rate at which the prices for goods and services increase.

It affects everything from mortgages to the cost of our shopping and the price of train tickets.

It’s one of the key measures of financial well-being, because it affects what consumers can buy for their money. If there is inflation, money doesn’t go as far.

Food prices rose between September and October, with most of the increase coming in fruit and vegetables, the ONS said.

Analyst firm Capital Economics said food price inflation could continue to rise in November as supermarket demand continues to increase during the Covid-19 lockdown.

During the first lockdown, there was a fall in the amount of supermarket promotions as shoppers bulk bought essentials.

Some surveys of consumers had suggested renewed stockpiling as health restrictions spread through Scotland, Wales and Northern Ireland in October.

A one-month lockdown was announced for England at the end of the month and started on 5 November.

Second-hand car prices also rose in October as people tried to reduce their reliance on public transport.

However, car prices may stabilise and fall back in the middle of 2021 should a vaccine become widely available, according to Samuel Tombs, chief UK economist for Pantheon Macroeconomics.

One of the largest downward pressures on inflation came from a fall in household energy prices.

Gas prices dropped by 12.3% and electricity prices fell 3.2% between September and October.

This was mainly due to energy regulator Ofgem’s latest six month energy price cap, which came into effect on 1 October, the ONS said.

Inflation may have ticked up in October but delve into the figures and you’re reminded: it’s not the risk of inflation that looms large right now but the opposite.

Services are still rising in price but if you take the price of goods there’s been no inflation at all in the past year.

The price of energy fell – not only this time because of the price cap, but because anti-virus measures have caused a sharp economic contraction worldwide, cutting global demand and pulling down the wholesale price of oil and gas.

Where some prices are slowly rising, the national lockdown measures currently in place can only exert further deflationary pressure.

There’s not a lot the Bank of England can do here to stimulate activity when the battle against Covid is pulling in the other direction.

But if we’re to avoid deflation, further fiscal measures may be needed to stimulate and repair a stricken economy once mass vaccination is underway. – bbc.com