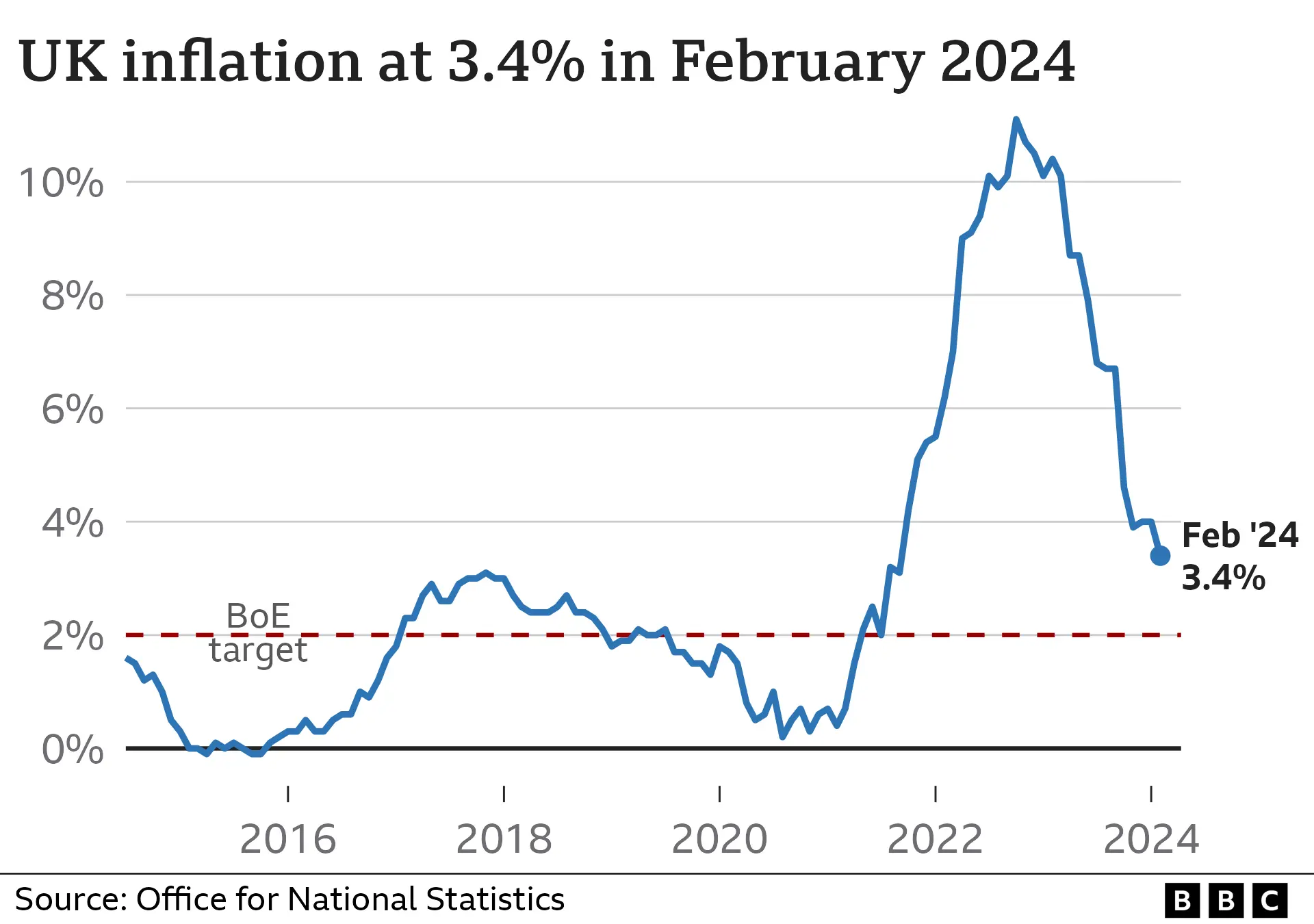

Inflation fell to 3.4% in February, down from 4% in January and edging closer to the Bank’s target of 2%.

The drop means the cost of living is rising at its slowest pace since September 2021, when it stood at 3.1%.

Inflation, the rate at which prices rise over time, has been gradually falling since it hit 11.1% in October 2022, its highest rate for 40 years.

The Office for National Statistics (ONS) said slowing food price inflation was the main reason for the drop.

However, prices are not yet falling they are just rising less quickly than they were previously.

While food, restaurants and cafes saw the biggest slowdown in price rises, alcohol and tobacco, clothing and footwear also experienced a slowdown, according to the new ONS figures.

However, housing and household services costs and motor fuel bucked the downward trend and continued their rise in price increases.

Grant Fitzner, chief economist at the ONS, said one of the reasons for the bigger than expected drop in last month’s figure was the fall in food price inflation which had come down “quite a bit” from 6.9% to 5%.

“That’s 11 consecutive monthly falls… in fact we haven’t really seen much change in food prices for the last nine months, they’ve been almost flat,” he said.

“These falls were only partially offset by price rises at the pump and a further increase in rental costs.

“But the general trend continues to be lower,” Mr Fitzner said.

Overall prices were “still higher than they were a year or two years ago, [but] the rate of inflation has come down markedly,” Mr Fitzner added.

However, speculation about an impact on prices as a result of disruption in the Red Sea had not materialised, mostly because the rate of sterling had increased and the UK’s ability to pay for imports had improved, he said.

Most economists had predicted the drop in inflation and said it would further expectations that the Bank will cut interest rates later in the year.

The figure comes ahead of its latest interest rate decision on Thursday, which is expected to see rates held at 5.25%.

Chancellor Jeremy Hunt said people would “heave a sigh of relief” at the inflation figures but insisted it was “far too early to know” whether the government would be in a position to cut taxes before the general election.

However, he added: “As inflation gets closer to its target that opens the door for the Bank of England to consider bringing down interest rates, that brings down mortgage rates, that makes a very big difference,” he added.

But Labour said after 14 years under the Conservatives “working people are worse off”.

“Prices are still high, the tax burden is the highest it has been in 70 years and mortgage payments are going up,” shadow chancellor Rachel Reeves said.

Sorry. No data so far.