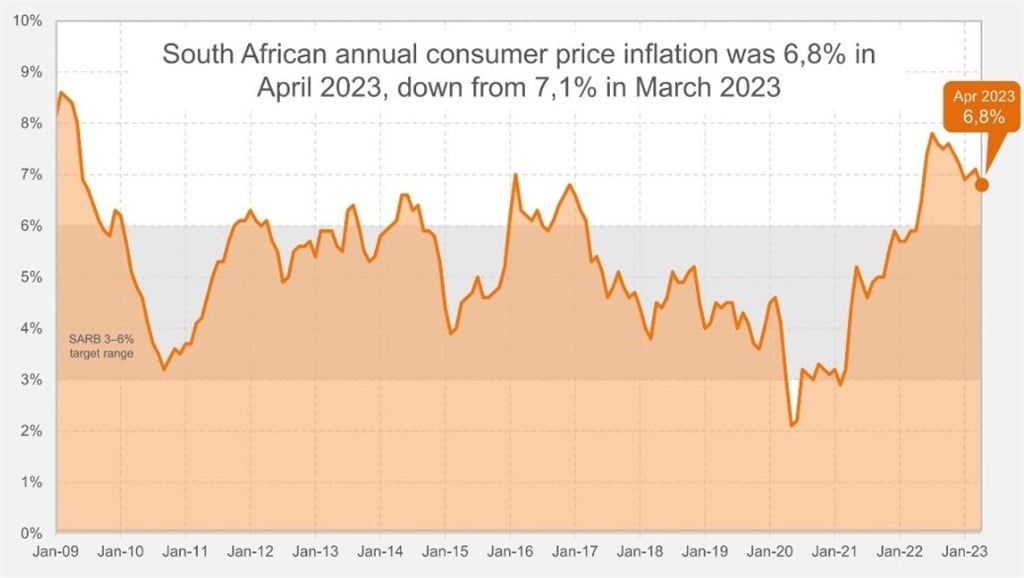

April’s annual consumer price inflation cooled to 6.8% after reaching 7.1% in March.

This is the lowest inflation number since May 2022, when the rate was 6.5%, Statistics SA said. The consumer price index (CPI) increased by 0.4% between March and April.

But food inflation continues to be red hot – prices of food and non-alcoholic beverages eased only slightly to 13.9%, from a 14-year high of 14.0% in March.

Prices of bread and cereals increased by 20.8% in the 12 months to April – even higher than 20.3% in March. And prices in the milk, eggs and cheese category rose by 14.5% – the biggest increase since 2009. Statistics SA notes that the average price of a two-litre carton of fresh full-cream milk increased from R30.14 to R35.88 over the past year.

Vegetable prices continue to rocket, rising 23.1% over the past year, the biggest increase in 15 years. Onions are now almost 53% pricier than a year ago, with potato prices up 24%.

But the price hikes of meat are cooling, from 10.6% in March to 9.5% in April. Statistics SA says inflation for oils and fats slowed for an eighth consecutive month, falling from 16.0% in March to 9.9% in April. “The last time this rate was in single-digit territory was November 2020,” notes the agency.

Adding to the easing in inflation are fuel prices, which increased by 5% in the year to April – the lowest level in almost two years. New vehicle price hikes also cooled to 6.7% – but used vehicles are still almost 13% more expensive than a year ago.

Housing and utilities increased by 4.1% year-on-year. While the inflation rate for goods was 9.0% in the year to April (down from 9.4% in March), prices for services rose to 4.7%, up from 4.5% in March.

The April inflation number comes a day before the SA Reserve Bank’s Monetary Policy Committee announces its latest decision on interest rates, and may raise hopes that the hike could be contained to 25 basis points. However, the rand’s crash to a record low in the wake of US allegations that Russia received arms in South Africa will be a big consideration. This has increased the odds of a 50 basis point hike, as a weaker rand will fuel inflation.

South Africa imports almost all its fuel (in dollars). Other imports will also be more expensive, but also locally produced maize and wheat. Their prices are determined by international prices, usually in dollars.

Investec chief economist Annabel Bishop previously pointed out that the weak rand contributed about half of the rise of domestic food prices. The rand has lost more than a fifth of its value over the past year.

Theoretically, a bigger interest rate hike should support the rand, making it more attractive for foreign investors in search of yield.

But another aggressive interest rate hike will inflict even more pain on a bleeding economy, which may already be in recession. The rand may even take a hit as investors worry about a growing economic crisis.

The central bank has delivered 425 basis points of tightening since November 2021, with March’s bigger-than-expected 50 basis point move surprising financial markets.

Some economists expect the first interest rate cut only at the start of next year. – bbc.com

*Correction: Consumer price inflation for May is 6.8%, not 6.5% as reported initially. News24 regrets the error.