Disney chief executive Bob Iger and Rupert Murdoch

WALT Disney has agreed to buy the bulk of 21st Century Fox’s business for $52.4bn (£39bn), in a deal both companies said position them to compete in the rapidly changing media industry.

The purchase includes Fox’s film and television studios, as well as its 39% stake in satellite broadcaster Sky.

Fox will form a news-focused company with its remaining assets.

The move is a sharp shift for 86-year-old Fox owner Rupert Murdoch after more than half a century of media expansion.

Mr Murdoch turned a single Australian newspaper he inherited from his father at the age of 21 into one of the world’s largest news and film empires.

He said the break-up makes sense amid new threats from online advertising and competitors who are streaming entertainment into homes via the internet.

Fox shareholders, which include the Murdochs, will get a 25% stake in the larger Disney.

“With today’s announcement, we launch the next great leg of our journey,” Rupert Murdoch said on Thursday.

Disney will scoop up Fox’s movie and television studios, regional sports network and international holdings, among other investments.

The move adds to Disney’s back catalogue high-grossing films such as the original Star Wars movies, the Marvel superhero pictures, Avatar and Deadpool, as well as TV hits such as Modern Family and The Simpsons.

It expands Disney’s offerings with the FX and National Geographic cable channels, and Fox’s regional sports network in the US.

The purchase also extends Disney’s global reach, adding media company Star India and Fox’s interests in Sky plc and Tata Sky to its portfolio.

Disney will also get majority control of the video streaming service Hulu, which is also partially owned by Comcast and Time Warner.

Disney will assume $13.7bn in Fox debt as part of the stock deal, taking the total value of the transaction to more than $66bn.

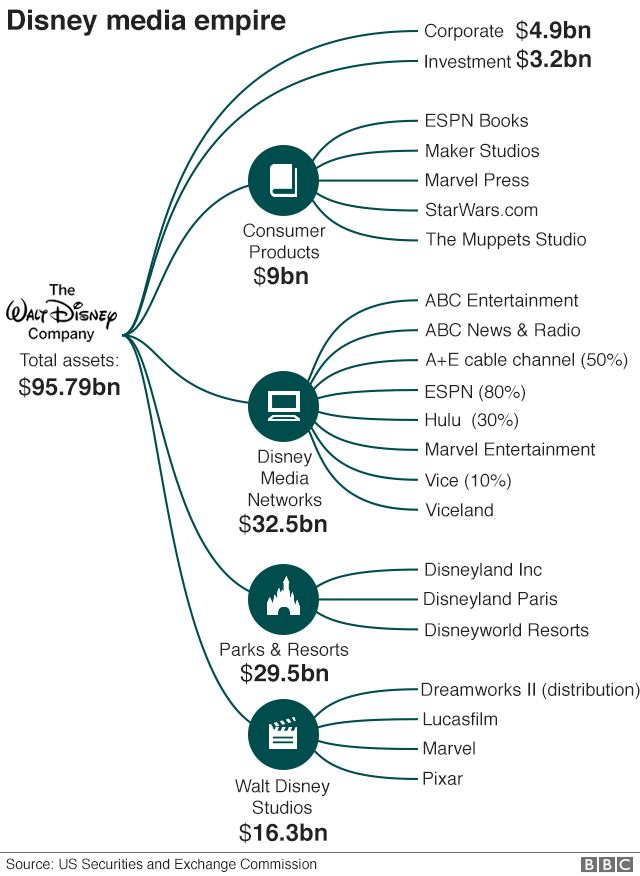

Disney already owns a vast array of news, film and leisure companies. But the media landscape is changing as technology companies like Amazon and Netflix attract customers to new ways of viewing.

Disney is investing heavily in online streaming platforms, as a way to counter a downturn in its pay-TV business and threats from these new rivals.

The firm believes this deal will give it the scale to compete, and expects to wring “at least” $2bn in cost-savings out of the new company to boot.

David Yelland, former editor of the Murdoch owned Sun newspaper in the UK, told the BBC the transaction puts Disney in pole position to compete with California’s tech giants.

“In ten years time there’ll be two Chinese giants and four US giants and [of the current entertainment companies] the only one that’ll survive will be Disney.”

Fox is creating a smaller firm focused on news and major live sports events in the US.

It will hold onto its flagship Fox News Channel, Fox Business Network, Fox Broadcasting Company, Fox Sports, Fox Television Stations Group, and sports cable networks FS1, FS2, Fox Deportes and Big Ten Network.

Lachlan Murdoch said: “While the merged business is about scale, the new Fox is about returning to our roots as a lean, aggressive, challenger brand.”

There has been speculation the deal opens the opportunity to reunite Fox with the news businesses which were spun-off in 2013 following a scandal over phone tapping in the UK.

That prompted the creation of a separate news publishing group, News Corp., which owns the Times and the Sun newspapers and remains controlled by the Murdochs.

Rupert Murdoch said the firm hasn’t looked at that possibility and any move along those lines is “way ahead” in the future.

As part of the deal Fox shareholders will receive Disney stock, representing about 25% of the enlarged company.

In the UK, Fox is in the midst of a bid to buy the part of the broadcaster Sky that it doesn’t already own. That bid is being investigated by the Competition and Markets Authority (CMA), which is due to publish provisional findings in January.

The BBC understands that the Disney deal will not alter that CMA investigation.

If the Sky purchase is approved, that deal would probably go through before the Disney purchase of Fox assets. So the whole of Sky would then be likely to transfer to Disney’s ownership.

If not, then just the 39% of Sky currently in Fox’s stable passes to Disney.

Rupert Murdoch said: “If things go wrong, the existing [Sky] shares go to Disney. It will be up to them to decide what to do.”

Either way Sky’s future will lie primarily in Disney’s hands.

Most observers expected Rupert Murdoch to hand over his vast media empire to his two sons James and Lachlan.

So the decision to break it up came as something of a surprise.

However, James, has been widely tipped to take on a senior role at Disney.

On Thursday, Disney boss Bob Iger, who is staying in his role running Disney until the end of 2021, said James will be involved in the integration of the two firms.

As for the future he said: “He and I will continue to discuss whether there’s a role for him here or not, but I look forward to talking to him about it.”

The management of the new Fox company is still being discussed.

The companies said they expect to complete the transaction in 12 to 18 months.

But it is not clear how the deal – which increases consolidation in the movie and sports media industries – will be received by US competition regulators.

The US Department of Justice recently sued to block AT&T’s $85.4bn deal to buy Time Warner, on the basis that it will raise prices for consumers and competitors.

It is possible they would take a similarly dim view of a Disney-Fox tie up.

The Writers Guild of America West, a union that represents writers for television and movies, said it opposes the deal on the grounds that it would increase Disney’s already sizeable power.

It said: “The antitrust concerns raised by this deal are obvious and significant.”

The Simpsons would become part of Disney’s catalogue

The Simpsons would become part of Disney’s catalogue