Prices are continuing to rise at their fastest rate for more than 40 years, driven by higher petrol and food costs.

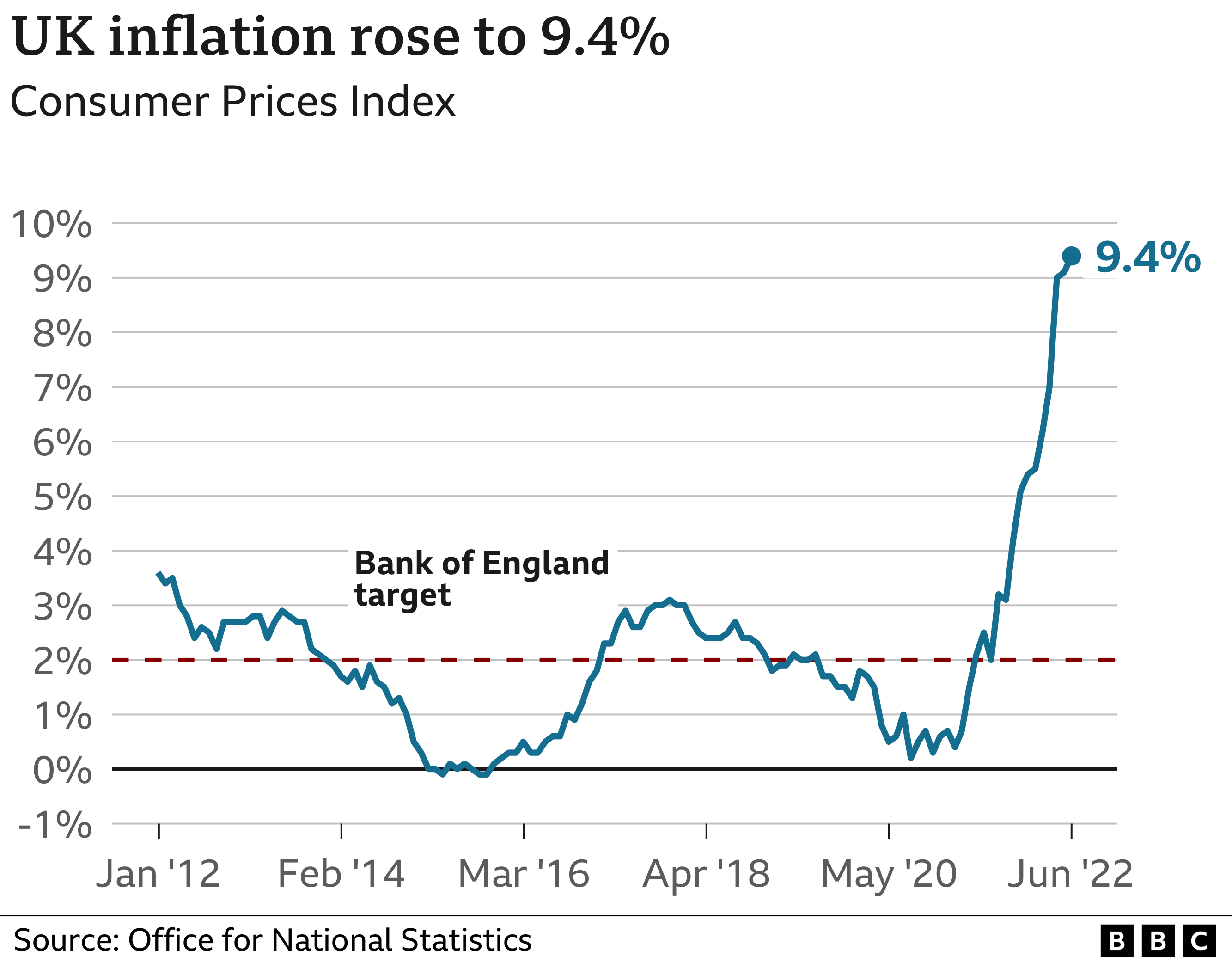

UK inflation, the rate at which prices rise, jumped to 9.4% in the 12 months to June from 9.1% in May, the Office for National Statistics (ONS) said.

Petrol prices rose by 18.1p per litre in June, while costs for milk, cheese and eggs also climbed, the ONS said.

Unions have been calling for pay rises to help workers cope as the rising cost of living eats into household budgets.

Inflation is the pace at which prices are rising. For example, if a bottle of milk costs £1 and that rises by 5p compared with a year earlier, then milk inflation is 5%.

Fuel prices have soared in recent months, driven by the war in Ukraine and moves by the European Union to reduce its dependence on Russian oil.

It has led to the average family car costing more than £100 to fill up, according to the RAC. However, the AA said this week that lower wholesale costs of fuel were leading to cheaper prices at the pumps, though they still remain much higher than before the Ukraine war.

Average petrol prices stood at 184p per litre in June, the ONS said, the highest since records began in 1990 and up from 129.7p a year earlier. The monthly rise was also the largest on record.

The average price of diesel in June was 192.4p per litre, again a record high, the ONS said.

Elsewhere, food prices have been climbing, with costs increasing at the fastest rate since March 2009.

Milk, cheese and eggs saw the biggest rises in June, latest figures show, with the prices of vegetables, meat and ready meals also climbing.

Research firm Kantar has predicted supermarket bills are set to rise by an average of £454 this year. This comes as energy bills, which rose by an unprecedented £700 a year in April for a typical household, are forecast to climb again in October.

Prices charged in restaurants and for accommodation have also increased, climbing by 8.6% in the year to June, the ONS said.

The agency said a survey asking businesses how inflation and higher running costs were affecting them revealed that over half had absorbed the costs, while just over a third said they had been forced to pass them on to customers.

As Bank of England Governor Andrew Bailey said in his Mansion House speech on Tuesday night, the inflationary pressures on the economy are no longer just global, they are domestic too. The labour force has shrunk, making it harder to recruit and pushing up wages.

“This increases the risk that the inflation that has come to us from abroad gets embedded in more persistent domestic inflationary pressure, ” he said.

The headline inflation rate in the UK is already the highest of the advanced G7 economies. And much criticism has come the Bank of England’s way in the Conservative leadership campaign.

But labour shortages are far more directly under government policy control and yet they are barely being discussed in the leadership debate.

The higher rates of inflation will make the conversation with public sector workers yet more tense. And all roads appear to lead to a rise in base interest rates next month of half a percentage point – the biggest rise in nearly three decades.

Other countries around the world are also experiencing a cost of living squeeze, with many affected by the same global factors as the UK.

However, the UK’s inflation rate is currently higher than others in Europe, with the latest estimates of annual inflation for Germany at 8.2% and for France at 6.5%

Meanwhile in the US, inflation hit 9.1% in June, just shy of the UK’s figure.

Chancellor Nadhim Zahawi said the government was working with the Bank of England to “bear down on inflation”.

“Countries around the world are battling higher prices and I know how difficult that is for people right here in the UK,” he said.

But Labour’s Shadow Chancellor Rachel Reeves said rising inflation could push family finances “to the brink” after a decade of slow wage growth.

“It’s the result of a decade of Tory mismanagement of our economy meaning living standards and real wages have failed to grow,” she said.

On Tuesday, the government announced that the police and most NHS staff would get below-inflation pay rises.

It has consistently said that big wage increases to meet the rising cost of living could end up causing a 1970s-style “inflationary spiral”, but Unite General Secretary Sharon Graham said the announcements were “a kick in the teeth”.

The Bank of England has warned inflation will reach 11% this year.

Rebecca McDonald, chief economist at the Joseph Rowntree Foundation, said rising prices were “wiping out pay increases.

“The cost of living crisis is only worsening and no time can be lost in preparing the country for profoundly difficult months to come,” she said.

Bank of England Governor Andrew Bailey has said rates could rise by as much as 0.5% at its next rates meeting in August in a bid to stem rising prices. That would take them to 1.75%.

One way to try to control how fast prices are rising is to put up interest rates. The aim is to increase the cost of borrowing so that people borrow and spend less, and save more.

But some economists doubt higher rates will fully stop today’s inflation, which is largely driven by global factors such as the war in Ukraine and the impact of Covid on supply chains. – bbc.com