AS Zimbabweans go to vote today, focus is slowly shifting to the enormous task facing the new administration to be ushered into office soon.

AS Zimbabweans go to vote today, focus is slowly shifting to the enormous task facing the new administration to be ushered into office soon.

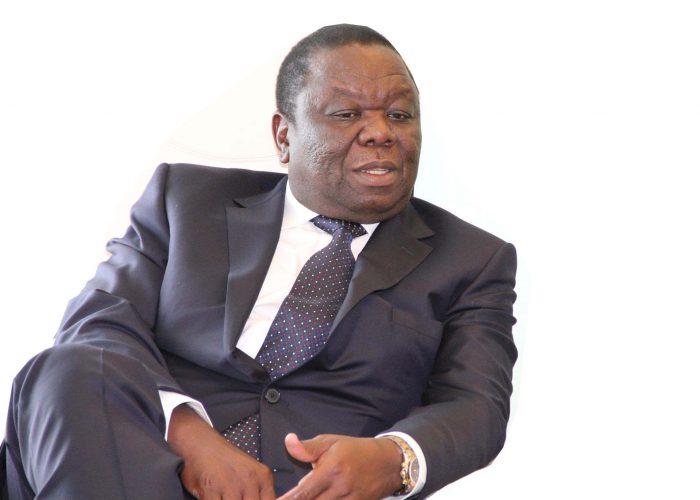

The coalition government of President Robert Mugabe, Prime Minister (PM) Morgan Tsvangirai and Deputy Prime Minister Arthur Mutambara assumed governing powers in February 2009 and today’s general polls will force them apart, with a single party assuming the reins of power soon after the winner has been sworn in.

Farmers would call it harvest time; students refer to it as examination time; expectant couples would equate it to moments in the labour ward while veterans of the Second World War would say it’s D-Day.

Zimbabweans are all the above today. They are at crossroads and a decision reflective of the people’s will must come out of today’s voting in order to take the country forward.

This is the only day politicians get to know who their real bosses are: Those who have done well and deserve to pass the test would be rewarded for their efforts. But those who took the electorate for granted would certainly be shown the exits.

Interestingly, today is also the only day when an “axe” on a politician’s score sheet would be a cause for celebration. Not even a “tick” would bring a smile to a politician as it would in the case of a student who has just sat for an exam.

Such is the animal called elections.

While the three main political parties fighting it out in this election namely ZANU-PF and the two Movement for Democratic Change (MDC) formations unveiled impressive election manifestos that promise to transform the lives of ordinary citizens, it would not be as rosy for them to walk the talk once ushered into office.

There are enormous pressing issues confronting the new government in the areas of health, education, infrastructure development and the economy in general awaiting the new administration.

These must be tackled with speed in order to address the political and economic crisis that has traumatised Zimbabweans for more than a decade now.

It was Sir Isaac Newton, a renowned scientist, mathematician and professor, who once remarked that he could calculate with a 100 percent degree of accuracy, the distance between stars or between planet Earth and the Stars but could not with any degree of certainty, predict the behaviour or reaction of man to any or all situations.

Similarly, Zimbabwea-ns must accept that it would be difficult to predict the behaviour of politicians once they have been voted into office.

This is the difficult part facing Zimbabweans who shall be trooping to polling stations today.

What is, however, certain as the sun rises from the east and sets in the west is that whether it is President Mugabe, PM Tsvangirai or Welshman Ncube of the MDC to win this election, the new administration faces similar challenges that need to be addressed sooner rather than later.

Zimbabweans can confidently put their finger on all the challenges that are weighing down the country’s economy but what they have been failing to do over the years is to confront them head on.

The elephant in the living room has been political bickering which, hopefully, would end once a new administration has been ushered into office.

The political squabbling in the inclusive government has brought about uncertainty which has been the biggest enemy undermining Zimbabwe’s economy.

For Zimbabwe’s economic engine to fire from all cylinders, peace and stability would be a prerequisite before, during and after the elections. While peace and stability have largely been achieved going into today’s elections, the challenge is that of maintaining the peace thereafter. Only that would guarantee free passage and legitimacy for any political party or leader who will emerge from the electoral process.

After that, a catalogue of other challenges need to be dealt with.

The most critical one is liquidity which is slowly bringing industry and commerce down on its knees. This should be dealt with by putting in place holistic policies that tackle the major sources of liquidity under a multi-currency system.

Among them is the need to stimulate exports, attract external lines of credit and donor funds; drum up foreign direct investment (FDI), portfolio investment and Diaspora remittances; securitisation of the country’s minerals; create a good rapport with multilateral institutions and plead for debt write-offs.

Other measures to ease liquidity pressures should include mineral beneficiation, effective contract farming, import substitution and the introduction of money market instruments.

Any regulations that temper with any of these sources of foreign currency inflows result in reduced liquidity, which is critical for oiling the economy.

The net result of such tempering will be reduced overall credit to the productive sectors by banks, as well as reduced economic activity, which exacerbates unemployment and economic hardships.

A case in point is the implementation of the indigenisation and economic empowerment regulations which, in their current form, discourage FDI, thereby adversely affecting one of the major sources of liquidity.

Another critical area is that of confidence, which is currently at rock bottom. To reboot confidence, there is need to revisit the implementation of the indigenisation regulations in order to instill confidence in the management of the country’s economy.

Confidence in an economy encourages both domestic and foreign investment in all the sectors of the economy, resulting in sustained growth and development. It also encourages the much-needed domestic savings and increased use of the formal banking channels.

There is also dire need for policy consistency. At the moment, one group announces a policy or regulation, and the other group refutes it. There is therefore need for teamwork and speaking with one voice as one government.

For industrial harmony and order, it is also necessary that investors, particularly foreign investors, are accountable to the nation, and adhere to local laws and regulations while operating their enterprises within the country.

In this respect, the next government must deal with the Chinese factor in investment in Africa. While China is perceived to be a friend of Zimbabwe, their investment in the country remains very little, compared to Chinese interests in other parts of Africa.

For instance, out of US$316 billion outward investment by China as at 2005, sub-Saharan Africa only received US$13,8 billion.

China’s investment patterns in Africa also show a picture that does not feature Zimbabwe as prominently as other African countries, with Zimbabwe falling in a group that has received less than US$400 million worth of investment.

Even Chinese imports from Africa, which could help to lift local industries, are lowest for Zimbabwe.

On the back of these glaring discrepancies on the patterns of Chinese investment and trade in Africa, this may call for a re-look at the Look East Policy.

Sanctions are also real in Zimbabwe’s context. They have had a debilitating effect on the economy over the past 12 years. However, there seems to be some positive moves to gradually remove them, as indicated by both the European Union and the United States.

While these maneuvers should be commended, it is important to note that the damage to the economy has already been done, and that this country cannot bear these sanctions any day longer.

It is also important to note, however, that the US sanctions, which are epitomised through the Zimbabwe Democracy and Economic Recovery Act, would take some time to undo, as this process is through the US Senate.

The influx of Zimbabweans from the Diaspora back into the country is also a double-edged sword.

On the positive side, the skills earned in the Diaspora would be useful to augment the available local human resource base while on the other hand, unemployment could increase as the large numbers of Diasporans coming home cannot be absorbed by a shrinking industrial base. This could lead to instability and social unrest if the next government does not take this inconvenient truth into consideration.

It also goes without saying that the policies to be adopted should specifically target the key sectors of the economy namely agriculture, mining, tourism, manufacturing and services.

Agriculture depends on the wea-ther patterns, so output tends to be limited and volatile.

Mining is capital intensive and requires foreign capital. This is where issues of confidence and indigenisation laws become more relevant in creating an enabling environment for FDI attraction.

The manufacturing sector requires stimulus packages for the sector to recover. Industry also requires medium to long-term finance to replace antiquated equipment and machinery.

The lingering external debt and arrears overhang requires accelerated engagement with the international community, in order to resolve the debt crisis.

Clearly, financial sector stability will equally be critical in underpinning the country’s growth prospects.

Although the financial sector is generally safe and sound, it is currently bedeviled with issues of corporate governance, which threatens the soundness of some of them.

While on the subject of financial sector stability, the use of multiple currencies should also remain in force in near to medium term, and there should be no reversion to the Zimbabwe dollar soon.

Other essential areas that cannot go unmentioned include serious investment in the country’s infrastructure, essentially energy, roads, rail, air, telecoms, municipalities, water, health and schools infrastructures.

Given the liquidity challenges in government, the best way to go would be to revamp the country’s infrastructure through public private partnerships.

Zimbabwe should also avoid wasting the intrinsic value in its parastatals, most of which are incurring heavy losses.

To avoid overburdening the taxpayer, these should be commercialised as the government prepares them for privatisation.

But to achieve all this, the climate should be conducive for both domestic and foreign investors and there must be zero tolerance to corruption and the respect of rule of law.

Analysts are basically agreed on what needs to be done to move the country forward.

Ricky Mukonza, a political analyst, said the first priority for any party that emerges victorious would be to rally all Zimbabweans, irrespective of their political persuasions, towards a single national goal after their attention had been diverted by partisan agendas related to the polls.